South Korea is beginning the mass production of a low-cost laser weapon that has successfully shot down small drones during testing, the country’s key arms agency said Thursday.

The laser weapon, called Block-I, “can precisely strike small unmanned aerial vehicles and multicopters at close range,” a news release from South Korea’s Defense Acquisition Program Administration (DAPA) said.

The release did not give a cost for the weapon, but said each shot fired would only cost about $1.50.

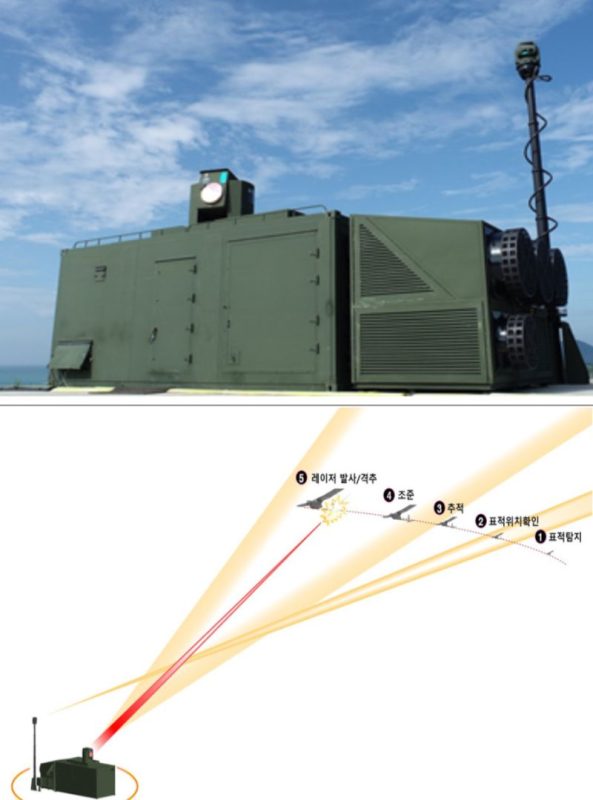

Imagery supplied by the agency appears to show a weapon around the size of a shipping container with a laser mounted on top and what appears to be a radar or tracking device mounted on one side of the platform.

DAPA said the unit measures 9 meters by 3 meters by 3 meters (29.5 feet by 9.8 feet by 9.8 feet), and fires laser rays that are difficult if not impossible to detect before impact.

“It is invisible and noiseless, does not require separate ammunition and can be operated only when electricity is supplied,” the DAPA release said. Future versions could be developed to take out much bigger targets, including aircraft and ballistic missiles, which would be a potential “game changer,” according to the release.

DAPA will develop “a laser anti-aircraft weapon (Block-II) system with improved output and range compared to the current one,” the release said.

But the Block-I weapon itself comes online at an important time. In Ukraine, the Middle East and elsewhere, small drones – some available off the shelf – have shown the ability to disable or destroy multimillion-dollar pieces of military hardware, including tanks.

Militaries have typically responded by trying to take out low-cost drones with defensive systems that cost tens of thousands of dollars per strike. A weapon that could do the same for practically pennies would be a big boost to the country that can deploy it.

“Low-cost drones and rockets have swung the economic calculus of offense and defense in favor of those using large volumes of cheap unmanned systems and munitions to overwhelm more-sophisticated air and missile defenses,” James Black, assistant director defense and security for the RAND Europe think tank, wrote in a blog post in January.

DAPA said the Block-I weapon has been in development for five years, with more than $63 million invested.

The Korea Institute for Defense Analyses led the system development with participation from Hanwha Aerospace, it said.

The system was evaluated suitable for combat in April 2023 after achieving 100% success in shooting down targets in live-fire tests, according to DAPA.

The agency said South Korea is the first country to publicly acknowledge it will deploy a mass-produced laser weapon.

Earlier this year, Britain showed off a new laser weapon that its military says could deliver lethal missile or aircraft defense at around $13 a shot.

But no possible deployment date for that weapon had been announced.

In 2022, the US Navy successfully tested a high-energy laser system against a target representing a cruise missile.

But a Navy account of that test said there was no plan to get it into the hands of warfighters, adding that it “offers a glimpse into the future of laser weapons.”