On Friday mornings in our DP Diamonds subscriber-only trading room, the DecisionPoint Diamond Mine, I like to look for a “Sector to Watch” and an “Industry Group to Watch” within. These are for your watchlist and not necessarily ready for immediate investment. In the case of this week’s Sector and Industry Group to Watch, we will need to take our cue from Monday’s trading to know if this area of the market will thrive.

I picked Technology as the Sector to Watch. I could’ve easily picked Materials, Communication Services, Consumer Discretionary and Utilities, all of which are sailing higher. The big problem with those sectors is that the RSI is overbought on all of them, so price is overbought. Technology, on the other hand, has rising momentum and an RSI that is not overbought.

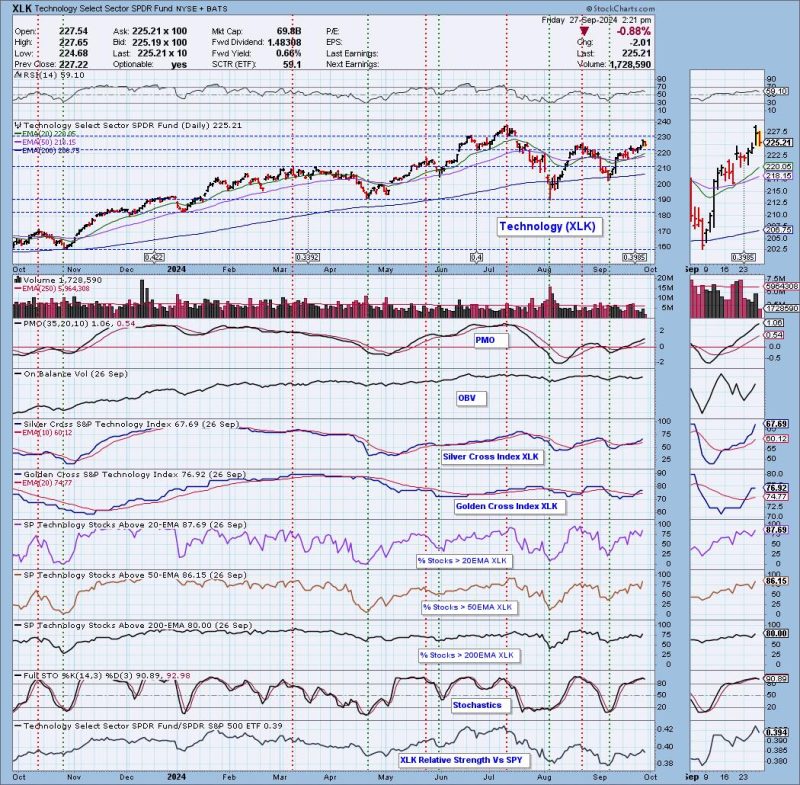

Let’s look “under the hood” at Technology. (FYI – We have under the hood charts for all of the sectors, indexes and select industry groups on our website available to subscribers of any of our subscriptions on the website). Technology is overcoming the previous top from August. As noted above, the RSI is not overbought and the PMO is rising above the zero line. I particularly liked the acceleration on the Silver Cross Index, which tells us how many stocks have a 20-day EMA above the 50-day EMA. Participation of stocks above key moving averages is very healthy reading in the 80th percentile. Stochastics did top, but are firmly above 80, suggesting internal strength. We can also see outperformance against the SPY. All of this adds up to a likely advance higher.

The Industry Group to Watch is Semiconductors (SMH). We happen to have an under the hood chart for this group, so we’ll review it. Price has reached overhead resistance and, as of this writing, it is pulling back. However, the internals look very strong. The RSI is not overbought and the PMO is rising above the zero line, indicating new strength. The Silver Cross Index is above its signal line and is reading above our bullish 50% threshold. Participation is strong and, in the case of %Stocks > 50/200EMAs, there is room for improvement before getting too overbought. Stochastics have topped but, as with Technology, they are comfortably above 80, indicating internal strength.

Conclusion: Next week, we should put Technology and Semiconductors on our radar. They may not be ready for primetime right away, so we do need to watch what the market does on Monday. If it decides to decline, this area of the market will likely be hit. If it decides to inch higher, these will be the areas to pay attention to.

Introducing the New Scan Alert System!

Delivered to your email box at the end of the market day. You’ll get the results of our proprietary scans that Erin uses to pick her “Diamonds in the Rough” for the DecisionPoint Diamonds Report. Get all of the results and see which ones you like best! Only $29/month! Or, use our free trial to try it out for two weeks using coupon code: DPTRIAL2. Click HERE to subscribe NOW!

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 Subscribe HERE!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)