(This is an excerpt from the subscriber-only DecisionPoint Alert)

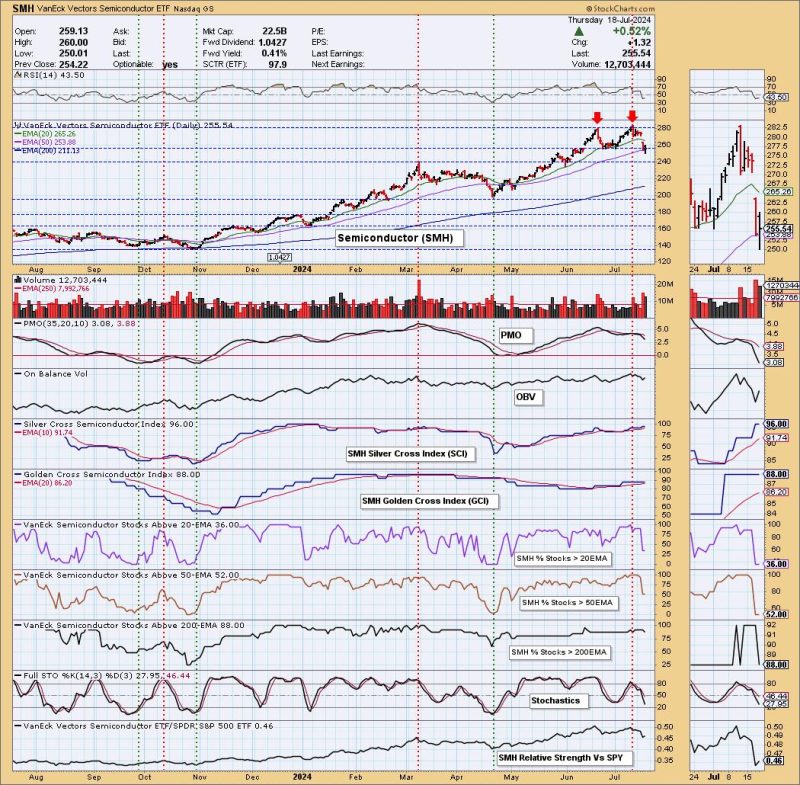

We noticed a double top on the Semiconductor industry group (SMH) that looks very much like the NVIDIA (NVDA) chart. NVDA is clearly the bellwether for the group and it appears all of the Semiconductors are feeling the pain. The downside target of this pattern would take price to at least 239.00. That would be the “minimum” downside target.

Participation is lagging. You can see how many stocks have lost support at their 20/50-day EMAs. The Silver Cross Index is still at a very healthy level so while many have lost support, they still have their 20-day EMAs above the 50-day EMAs. All is not lost, but certainly the declining PMO suggests more downside.

SMH has been running hot since the 2022 low. It did see some corrections along the way and it appears we are going in for another correction. So far this correction is only a 9.9% decline. We would look for more given the topping weekly PMO.

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)